DBRA vs. Davis-Bacon vs. Prevailing Wage vs. Certified Payroll vs. WH-347: What’s the Difference?

If you work on federally funded construction, federal tax credit, or federal loan projects, you’ve probably heard these terms used and not really known if they’re the same or different:

- DBRA

- Davis-Bacon

- Prevailing Wage

- Certified Payroll

- WH-347

- New WH-347

Contractors, subs, payroll administrators, and even public agencies mix these up constantly—and that confusion leads to missed requirements, rejected certified payrolls, and sometimes back-wage findings.

This guide breaks each term down (in normal language) and shows how they fit together so you can stay compliant without the headache.

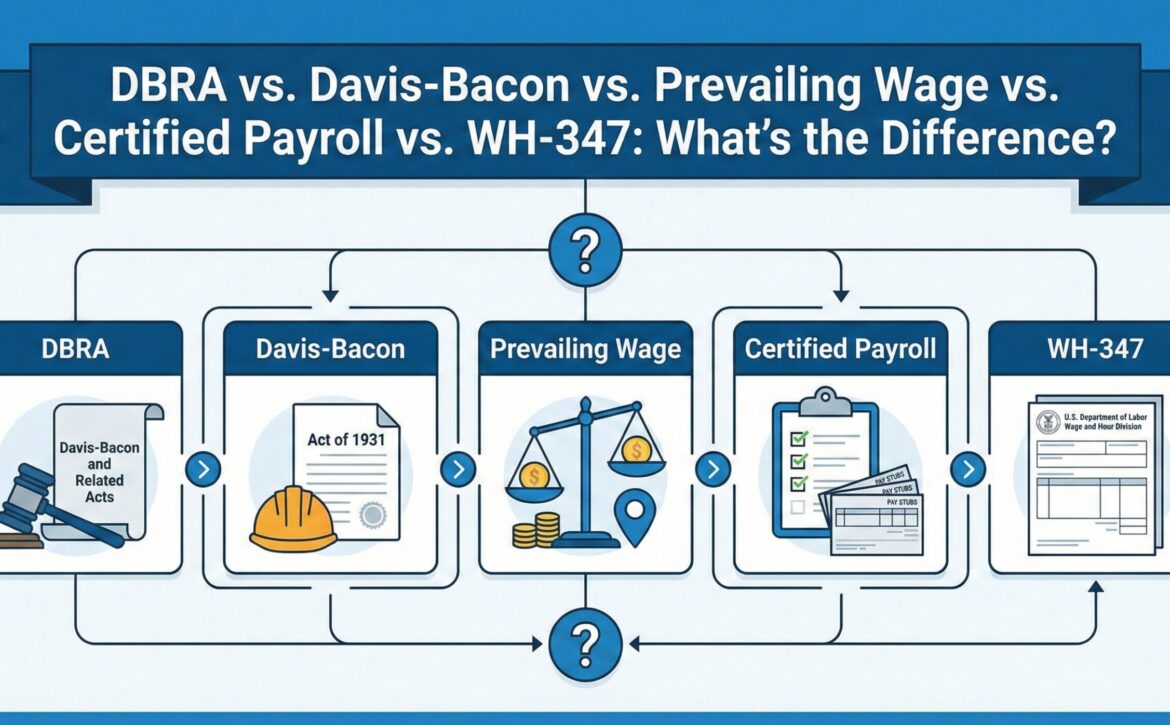

The Simple Hierarchy: How These Terms Connect

Think of the compliance ecosystem like this:

DBRA → Davis-Bacon → Prevailing Wage Requirements → Certified Payroll → WH-347 Form

- DBRA (Davis-Bacon and Related Acts) = the umbrella laws

- Davis-Bacon = the core act

- Prevailing wage = the wage + fringe rates you must pay

- Certified payroll = the weekly reporting proving that you complied

- WH-347 = one optional form you can use for that reporting

Once you see this structure, hopefully everything gets clearer.

DBRA (Davis-Bacon and Related Acts)

The umbrella laws that create the requirements

The Davis-Bacon and Related Acts (DBRA) are a group of federal laws requiring contractors and subcontractors on federally funded or federally assisted construction projects to pay prevailing wages to workers.

DBRA is broader than just federal construction. It includes dozens of “related acts” connected to agencies like:

- HUD

- DOT

- DOE

- EPA

- USDA

If your project uses federal funds—even partially—DBRA likely applies.

Why People Confuse It

DBRA is the legal framework, but many project documents simply say “Davis-Bacon.” That’s technically incorrect, but common.

The Davis-Bacon Act

The core law inside DBRA

The Davis-Bacon Act (DBA) is the main statute requiring payment of prevailing wages on federal construction projects over $2,000.

How It’s Different From DBRA

- DBA covers federal construction only.

- DBRA includes Davis-Bacon plus all the other acts that apply Davis-Bacon rules to federally assisted projects.

In short: DBRA is the umbrella; Davis-Bacon is the anchor.

Prevailing Wage

The wage + fringe rate you must pay workers

Prevailing wage isn’t a law—it’s the required wage standard set by the U.S. Department of Labor.

A prevailing wage rate is based on three things:

- Trade/classification (Electrician, Laborer, Operator, etc.)

- County where the work is performed

- The official wage determination issued by the Department of Labor

A prevailing wage is always two parts:

- Base hourly rate

- Fringe rate (cash or bona fide fringe benefits)

Why This Gets Confused

People often refer to the entire Davis-Bacon compliance process as “prevailing wage,” but it’s only the rate, not the reporting or the certification.

Certified Payroll

The weekly proof of compliance

Certified payroll is the weekly reporting contractors and subcontractors must submit to show they paid workers correctly.

Every certified payroll report includes:

- Worker and classification details

- Hours worked (regular, OT, weekend)

- Base rate + fringe allocation

- Gross pay

- Deductions

- A signed Statement of Compliance

Why People Confuse It

Many assume “certified payroll” = “WH-347,” but the WH-347 is just one version of a certified payroll report. Different agencies, including at the state and local levels, often have their own formats or require electronic submission portals.

The WH-347 Form

DOL’s optional certified payroll form

The WH-347 is a standardized Department of Labor form contractors can use to submit certified payroll. It includes the Statement of Compliance and all required reporting fields.

Important

The WH-347 is optional unless a contracting agency specifically mandates it.

Many primes and subs still prefer it because it’s simple and universally recognized.

Why Using the WH-347 Can Be a Benefit Compared to Other Certified Payroll Formats

Even though certified payroll can be submitted in multiple formats, the WH-347 offers several practical advantages—especially for subcontractors and smaller contractors.

1. Auditors Immediately Recognize It

Because the WH-347 is a DOL-issued format:

- Auditors know exactly where to find data

- Reviewers don’t need explanations

- There’s less back-and-forth during reviews

It reduces friction during audits and closeout.

2. It Eliminates Guesswork

The WH-347 guides you through:

- Workers

- Classifications

- Hours

- Rates

- Fringes

- Deductions

- Compliance signature

There’s no reinventing the wheel each week.

3. It Works on Most Projects Without Proprietary Portals

If the agency does not require LCPTracker, eCMS, B2GNow, or a custom spreadsheet, WH-347s are almost always acceptable.

Consistency matters—especially for subs working on multiple small federal projects each year.

4. It Reduces the Risk of Missing Required Fields

Custom contractor or agency forms vary widely. WH-347s do not.

Using a WH-347 ensures you don’t miss critical fields like:

- Fringe allocation

- Classification adjustments

- Total hourly compensation breakdown

- Statement of Compliance wording

5. Subcontractor-Friendly

Subs often don’t have a dedicated compliance officer. WH-347s:

- Are simple

- Are repeatable

- Require minimal software or training

For many teams, that simplicity is the difference between compliance and chaos.

6. Faster Prime Contractor Review

Primes reviewing dozens of subcontractors prefer standardized WH-347s because:

- Errors stand out immediately

- Roll-up reporting is easier

- Review cycles shorten

When everyone follows the same structure, fewer payrolls bounce back.

7. Clean Archiving for Closeout

WH-347s produce predictable, high-quality documentation that:

- Stores cleanly

- Exports easily

- Helps for multi-year or multi-agency audits

This saves hours during closeout and post-award reviews.

Bottom Line

WH-347s keep compliance simple, predictable, and audit-friendly. They remain the most contractor-friendly certified payroll format available.

The New WH-347 (2024–2025 Update)

Updated to reflect the 2023 Davis-Bacon Final Rule

The Department of Labor recently updated the WH-347 to align with modern Davis-Bacon regulations.

What Changed

- New fringe reporting structure

- Updated Statement of Compliance language

- Clarified classification and hours categories

What Stayed the Same

- Still optional

- Still recognized widely

- Still designed for weekly reporting

Many contractors are unaware the form changed, which is why tools like InSight IQ help ensure you’re using the correct version.

Quick Comparison Table

| Term | What It Is | Applies To | Why It’s Confused |

|---|---|---|---|

| DBRA | Group of laws | Federally funded/assisted construction | Sounds like a program rather than legislation |

| Davis-Bacon | Core act requiring prevailing wages | Federal construction | Used as shorthand for all DBRA |

| Prevailing Wage | Required wage + fringe | Fed & state projects | Mistaken for the entire compliance process |

| Certified Payroll | Weekly compliance report | Contractors & subs | Mistaken for WH-347 |

| WH-347 | Optional DOL certified payroll form | Projects without proprietary systems | Seen as “the required form” |

| New WH-347 | Updated DOL version | DBA/DBRA projects | Contractors unaware the form changed |

How InSight IQ Helps Contractors Do This Without the Stress

Most smaller contractors don’t need a bloated enterprise platform—they need something simple and accurate. That’s why we created InSight IQ, a streamlined system designed specifically for prevailing wage compliance.

With InSight IQ, you can:

- Automatically interpret wage determinations

- Track multiple classifications correctly

- Generate compliant WH-347s and agency-specific forms

- Catch errors before they reach the prime or agency

- Maintain a clean audit trail

- Reduce risk of back-wages and penalties

- InSight IQ aids in tracking apprentices on the job for the new WH-347

Whether you submit WH-347s or use an agency portal, InSight IQ makes certified payroll easier, faster, and more accurate.

Conclusion

These terms get mixed up constantly, and for good reason—they’re all connected. But once you understand the hierarchy, Davis-Bacon compliance becomes much more manageable.

- DBRA and Davis-Bacon create the rules

- Prevailing wages set the rates

- Certified payroll proves compliance

- The WH-347 is just one (very helpful) way to report it

If you want help navigating these requirements—or want to streamline certified payroll reporting—view our instant demo of InSight IQ.

FREQUENTLY ASKED QUESTIONS ABOUT PREVAILING WAGE, DBRA, DAVIS-BACON, WH-347 AND CERTIFIED PAYROLL

1. Is DBRA the same thing as Davis-Bacon?

No. Davis-Bacon is one law inside the broader DBRA framework. DBRA refers to Davis-Bacon plus dozens of related acts that apply prevailing wage requirements to federally assisted projects (HUD, DOT, EPA, DOE, etc.).

2. Do all federally funded projects require Davis-Bacon compliance?

If federal funds are used for construction, maintenance, or repair work, prevailing wage requirements almost always apply. Some exceptions exist, but the project owner or agency typically specifies DBRA applicability in the contract documents.

3. Is the WH-347 form required for certified payroll?

No. The WH-347 is optional unless a contracting agency mandates it. Contractors can use their own format or a compliance system like InSight IQ, as long as all required data fields are included.

4. What’s the difference between “prevailing wage” and “certified payroll”?

-

Prevailing wage = the hourly rate + fringe that workers must be paid.

-

Certified payroll = the weekly report proving workers were paid correctly.

One is the wage requirement; the other is the documentation.

5. When should contractors use the WH-347 form?

-

You want a standardized, audit-friendly format

-

The agency allows it or doesn’t specify a format

-

There is no proprietary reporting portal

-

You need a consistent form across multiple small projects

It’s especially helpful for subcontractors without dedicated compliance staff.

6. What changed with the new WH-347 in 2024–2025?

The updated form reflects changes from the 2023 Davis-Bacon Final Rule, including:

-

A revised fringe reporting layout

-

Updated Statement of Compliance wording

-

Clearer worker classification sections

It remains optional.

7. What happens if you submit certified payroll incorrectly?

Common consequences include:

-

Rejected payrolls

-

Delayed payment

-

Required resubmissions

-

DOL findings that may result in back-wages or penalties

Consistently accurate certified payroll reduces your audit risk significantly.

8. How can InSight IQ help with Davis-Bacon and certified payroll?

InSight IQ automates the most error-prone parts of compliance, including:

-

Interpreting wage determinations

-

Breaking out fringes properly

-

Generating WH-347s and agency-specific formats

-

Tracking classifications

-

Surfacing errors before submission

-

Automates payroll periods eliminating gaps and overlaps in reporting periods

It eliminates manual guesswork and keeps contractors compliant with less effort.